Knowing your future net worth is key for securing your financial future. We look at how investments, inheritance, and economic trends affect growth. Several factors, like market returns and planning strategies, shape wealth growth projections.

For example, money can double in less than 7 years with a 10% growth rate. By the “rule of 72,” a 20% return can double money in 3.5 years. Wealthfront predicts a $250,000 could grow to $1,080,486 in 30 years with a 5% market return.

Tools from PocketSmith and Empower assess future wealth based on spending and inflation. A Caste World article shows how Jameliz made smart investment choices in entertainment. Eliminating debt and adopting solid investment strategies helped improve her future net worth.

Key Takeaways

- Future net worth is vital for financial health.

- Investments and market returns greatly affect wealth growth.

- Smart financial planning boosts wealth accumulation.

- Wealthfront and PocketSmith offer precise net worth forecasts.

- Cutting debt and investing wisely boosts financial stability.

Understanding the Global Wealth Landscape

The wealth map around the world shows big differences among regions. Some areas are booming, while others grow slowly. The Asia Pacific (APAC) region has seen a massive increase in wealth per adult since 2008, beating the Americas and Europe, Middle East, and Africa (EMEA). It’s key to look at wealth trends and growth rates to get the whole picture of global wealth.

Current Wealth Distribution

Wealth varies a lot from one region to another. EMEA has the highest wealth per person but has grown just under 30% since 2008. This is much less compared to APAC’s huge 130% jump. The Americas have also seen their wealth per adult double in this time. These differences are important to understand how wealth grows in different areas.

In wealth per adult, EMEA is ahead, despite its slow growth. APAC’s wealth boom is helped by younger rich people who like investing abroad and in ethical ways. The Americas, while not growing as fast as APAC, still have impressive growth. This is partly because of an interest in tech and new kinds of investments.

Growth Rates by Region

Looking ahead, each area’s economic growth looks different, due to many reasons. APAC’s big leap in wealth comes from strong economies and a young, investment-savvy population. They like new options like cryptocurrencies and private equity. EMEA’s growth is slower because its markets are more established and its wealthy are often older.

The Americas are on an upward path, with wealth per adult doubling. Lower real interest rates, especially in the U.S., have helped increase wealth through real estate and stocks. Young investors here are optimistic about reaching their wealth goals, despite worries about the economy. They value being able to change their investment plans when needed.

| Region | Wealth Growth Per Adult (Since 2008) | Key Factors |

|---|---|---|

| EMEA | High wealth per adult, moderate growth, older investor base | |

| APAC | 130% | Rapid economic development, younger HNWIs, interest in foreign and ethical investments |

| Americas | 100% | Declining real interest rates, young investor confidence, preference for technology and alternative investments |

The Impact of Inheritance on Future Net Worth

As the world prepares for a huge shift in wealth, understanding inheritance is key. This is known as The Great Wealth Transfer. About $84 trillion might move to new hands in the coming years, mainly to Gen X, millennials, and Gen Z.

The Great Wealth Transfer

The upcoming shift in wealth is big news. Baby boomers will get $4 trillion of it. Gen X will get a huge part, $30 trillion. Millennials are not far behind with $27 trillion, and Gen Z will get $11 trillion. This shift is important not just for its size, but for its potential effects on the economy and society.

This big move of money will change how different generations invest. Some laws help avoid fights over wills through no-contest clauses. But, these can sometimes limit what beneficiaries can do with their wealth. The types of trusts and how they give out money will also influence how inheritance is managed.

Generational Differences in Investment Preferences

Most millennials and Gen Z investors think big returns can’t come from just stocks and bonds. They’re moving towards other kinds of assets instead.

Eco-friendly investments are a big hit with 73% of young investors, ages 21 to 42, choosing them. This is much higher than the 26% average across all ages. Moreover, 25% of these younger investors see private equity as a major chance for growth. This is compared to just 15% of older investors, those 43 and up.

| Generation | Estimated Inheritance | Key Investment Preferences |

|---|---|---|

| Baby Boomers | $4 trillion | Traditional Stocks and Bonds |

| Gen X | $30 trillion | Real Estate, Diversified Portfolios |

| Millennials | $27 trillion | Sustainable Investments, Private Equity |

| Gen Z | $11 trillion | Alternative Assets, Cryptocurrency |

These trends show us where the market might be going. With so much money moving to younger hands, we’re seeing more interest in sustainability and private equity. This will likely change financial strategies for the long run.

Strategies for Wealth Accumulation

Building wealth requires combining different investment strategies. This mix should include traditional and alternative investments, along with real estate. It’s important to diversify your portfolio due to the unique benefits and risks each strategy offers.

Investment Strategies

Traditional investment strategies form the base for growing wealth. Mixing stocks, bonds, and mutual funds can suit various risk levels. Financial experts like Michael Kitces suggest saving half of every raise for retirement. Automating savings helps ensure you don’t skip important contributions. Crafting a financial plan is key for identifying goals and successful tactics.

- Stocks are generally riskier but offer higher potential returns.

- Bonds provide more stability but lower returns compared to stocks.

- ETFs offer diversification by including a variety of securities.

- Mutual funds spread investments across various assets, reducing risk.

Using high-yield savings accounts (HYSAs) and making regular small investments leverages compounding. This method can significantly increase your net worth over time.

Embracing Alternative Investments

Younger investors are exploring alternative investments for diversifying portfolios. These include private equity, green investments, and even cryptocurrency. Although they promise significant growth, the risks are higher. Including these with traditional investments can lead to better outcomes.

| Traditional Investments | Alternative Investments |

|---|---|

| Stocks | Private Equity |

| Bonds | Cryptocurrency |

| Mutual Funds | Sustainable Investing |

The Role of Real Estate

Real estate remains key for wealth building across generations. The upcoming Great Wealth Transfer will impact real estate, focusing on eco-friendly homes. Homeownership builds equity and adds consistently to net worth, showing trust in this asset class.

Experts say that growing wealth involves saving steadily, creating an emergency fund, and upping retirement savings. A mix that includes real estate ensures financial strength, even when markets go down.

Projections for Future Net Worth

The global economy is on track to more than double by 2050. Emerging markets are growing faster than advanced ones. This change makes it easier for people to reach their long-term financial goals. Knowing future wealth trends helps in making smart investment and saving choices today.

Financial managers use the time value of money (TVM) to plan and budget funds. This helps in making long-term business plans. For example, to save $1 million in 20 years with a 12.2% yearly return, you need to save $984 monthly. Start saving now to achieve your future money goals.

A flexible investment plan is key in today’s changing markets. It’s important to pick investments based on your goals and time. Calculating future values of investments helps grow your wealth.

| Investment Options | Return Rate | Risk Level |

|---|---|---|

| Mutual Funds | Varies | Moderate |

| ETFs | Varies | Low to High |

| Retirement Plans | Variable | Low |

| Brokerage Accounts | Market Dependent | High |

New tech plays a big role in future net worth. Tools like future value calculators give better investment insights. Having a mix of investments helps manage risk well.

It’s wise to invest sustainably and keep your portfolio up-to-date with market trends. Whether saving for retirement, buying a home, or leaving a legacy, these methods help improve financial security.

Conclusion

The first step to predicting your future wealth is to understand the global wealth scene. Our in-depth research shows the way. By knowing how wealth is distributed and grows globally, you can spot great opportunities. The impact of inheritance and investment trends across generations is also key.

Building a strong financial future needs a mix of investment strategies. From stocks and bonds to more unique options like art or real estate, all play a part. The rapper Future’s journey from hit albums like DS2 to successful business projects shows how diverse investments work. By 2024, his net worth might hit $50 million, thanks to his varied income and smart planning.

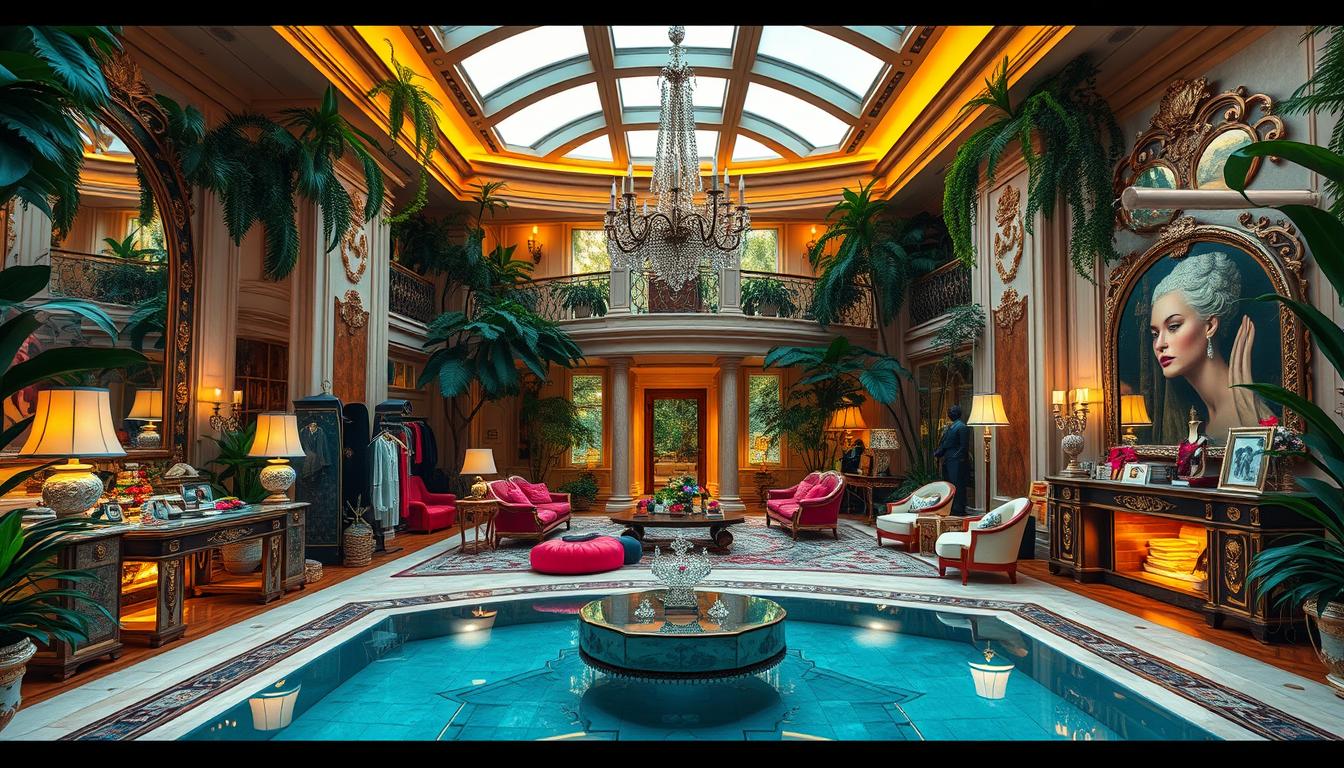

For monitoring finances, platforms like Kubera are crucial. They help manage assets and plan for the future in today’s changing economy. Future shows how blending Grammy-winning music with big real estate ventures, like a $16.3 million mansion in Miami, is smart.

Smart and informed financial planning is essential for growing your net worth. It’s about understanding global wealth, having a solid plan, and using the right tools to track progress. With this approach, your financial future can be as bright as the artist Future’s.